Watch the video and then scroll down to learn the full story.

About 12 Million Children in America—One in Six Kids—Are Being Raised in Poverty.

More children are in poverty than any age group.

It Gets Worse: Most of These "Children of Poverty" Will Also Raise Their Children in Poverty.

- 90% of women born in poverty in 1990 are raising children in poverty right now.

- 73% of children in poverty are children of color.

- 1 in 4 of those children are hispanic.

- Black children are 4 times as likely to spend their entire lives in poverty than a child of any other color.

It's an Endless Cycle of Economic Inequality.

It's an Endless Cycle of Racial Inequity.

This Reality Drives Much of the Turmoil in America Right Now.

Why Is This Happening?

A Major Reason:

Children are not taught the skills that keep them from being manipulated in a world driven by marketing.

Why Aren't Children Taught the Skills They Need?

Because the teaching of money skills is largely funded and controlled by the same organizations that make money when a kid makes money mistakes.

About 80% of the Funding of Financial Literacy in America Comes from Businesses That Profit from Money Mistakes.

Businesses That Profit from Money Mistakes Cannot Consistently Promote Skills That Hurt Their Businesses.

The Result?

Real financial literacy barely exists.

The major financial literacy resources in the world barely touch on the topics that must be taught.

The brutal cycle of economic inequality continues and increases.

A TOUGH REALITY:

Marketers constantly manipulate children.

Kids in poverty suffer the most from this manipulation. Marketers target kids with 19 billion dollars in advertising every year.

Marketers relentlessly customize marketing approaches to each child.

They target a kid's emotional state, interests, and fears. How is an adult—much less a kid in poverty—going to make wise decisions facing this reality?

Every Person in Poverty, or Caught in Racial Inequality, Needs the Skills FoolProof Uniquely Teaches.

FoolProof is the only major resource in America based on teaching healthy skepticism and caution.

We relentlessly tackle the issue of marketing manipulation.

We tackle marketing manipulation with humor and with 100% peer-to-peer teaching.

FoolProof is the only major financial literacy resource in America—literally—endorsed by these iconic consumer groups:

FoolProof Takes a 'TWO-GEN' Approach to Teaching Healthy Skepticism and Caution

FoolProof Has Literally Hundreds of Educational Resources.

Take a peek at a few...

FoolProofMe.org

Provides consumers a safe harbor to research consumer issues, products, programs and services.

View

Joey's Gist

From scam artists to data collection to impulse buying traps. Joey reveals all and gives you the keys to protect yourself against anyone who is after your money.

View

FoolProof Student Ambassador

We all want a good credit score, right? So how do you get one? Destanie gives you some tips and tricks on how she did it.

View

Resources for Parents

This page helps parents teach their kids the importance of using caution, questioning sellers, and relying on independent research before spending money.

View

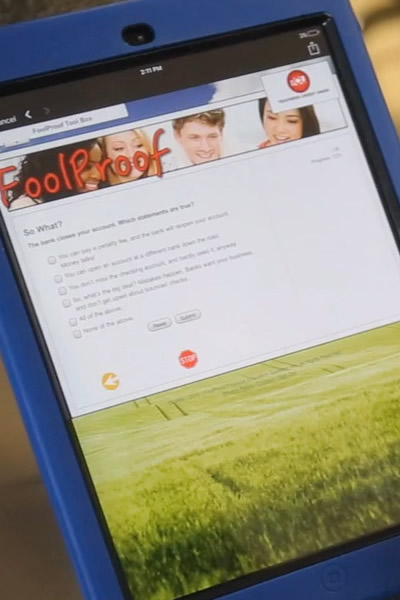

Middle & High School Curriculums

FoolProof gives teachers a unique and ethically-driven consumer life skills curriculum. We teach students the power of skepticism and how to identify and neutralize misinformation.

View

FoolProof University

Motivated to break barriers of cyclical economic inequality through education and outreach, FoolProof University offers 3 unique ways to do just that by creating stronger, more financially literate staff, students, parents, and communities.

ViewRemember the Kids Who Grew Up in Poverty with Few Skills?

FoolProof "Solo" teaches those adults the skills they need now to help them break the cycle of poverty.

Time Is Not Our Friend in This Fight.

The marketers are winning. FoolProof uniquely teaches the skills that can counter the marketers. But we cannot do this alone.

Over 14,000 FoolProof teachers already have free use of our powerful curriculums.

But we need to reach 100,000 teachers.

25 states are considering student financial literacy requirements.

The curriculums loved by marketers have hundreds of people knocking on doors in those states.

FoolProof has two people.

Ways to Help

Contact us!

You can contact Dr. Lennette Coleman, FoolProof's President, for more information on ways how you can help.

ContactHelp Us Fix This Problem, Now.

Every Person in Poverty, or Caught in Racial Inequality, Needs the Skills FoolProof Uniquely Teaches.

The Data behind the Conclusions on This Website.

Our messaging is based on the most current data about poverty and its causes. If you want to learn more, read these reports.

The Brookings Instituition

Tackling the legacy of persistent urban inequality and concentrated poverty

ReadAlternatives to Financial Education

For inclusion in The Handbook of Financial Literacy,

by Lauren E. Willis